January 2026 Newsletter

Happy New Year. I hope you've had a bit of rest and a good start to January.

A lot of people are heading into 2026 feeling two things at once: hopeful for what the year can bring, and a little tired of uncertainty, especially when it comes to money and housing. Both can be true. The good news is that the best outcomes usually come from planning early, not predicting perfectly.

A quick market note

We're still in a transition period. Rates have eased from their peak, but the broader economy is mixed and many people are feeling it, especially in the job market. That's exactly why having a plan matters. If you're concerned about income stability, affordability, or future flexibility, it's worth talking sooner rather than later.

If you want the deeper, numbers-based update, I wrote a short outlook here:

Read the 2026 rate & market outlook:

Our big focus for 2026: renewals

Renewals are going to be a major theme this year, and we're approaching them with one goal: help you renew with confidence and options.

If your mortgage matures in 2026, the best time to review your strategy is 4-6 months before maturity (earlier if you're self-employed, your income has changed, or you're considering refinancing). The reason is simple: when we start early, we can usually secure better flexibility, better structure, and less stress.

What we can do for you at renewal:

• Review your lender's renewal offer and pressure-test it

• Compare options across lenders (renew, switch, restructure, refinance)

• Lock in a rate in advance where possible

• Help you choose a term that matches your life and plans, not just the headlines

• Explore options like hybrid mortgages when you want both stability and flexibility

A quick, helpful benchmark

Many homeowners who began their mortgage in 2021 will see higher payments at renewal. As a general guide, that can be roughly $130-$150 more per $100,000 borrowed, depending on your remaining balance, amortisation, and new rate.

If you took a three-year term in 2023, your renewal picture may be different, sometimes steadier, sometimes lower, depending on where rates land and how your file qualifies.

The point isn't to worry. It's to plan. A renewal is a moment where small choices can have a big impact over the next few years.

If your mortgage renews this year, a quick check-in now can save stress later. We'll review your timeline, options, and what makes the most sense for your next term.

Our Commitment to Community

Living on the coast has shaped me since childhood, and it still keeps me grounded. It's a daily reminder of how connected we are to the ocean and the animals that live there, and how much care it takes to protect that world.

That's why Cultivate + Evolve Financial donates 1% of our annual profits to the Vancouver Aquarium Marine Mammal Rescue Centre (VAMMR). If you'd like to support their rescue and rehabilitation work, you can explore their adoption programme here: https://www.vammr.org/how-to-help/adoptions/

And one small fun thing: if you make a donation and send us a quick note or screenshot as proof, we'll enter you into our monthly draw to win a client gift box as a thank-you.

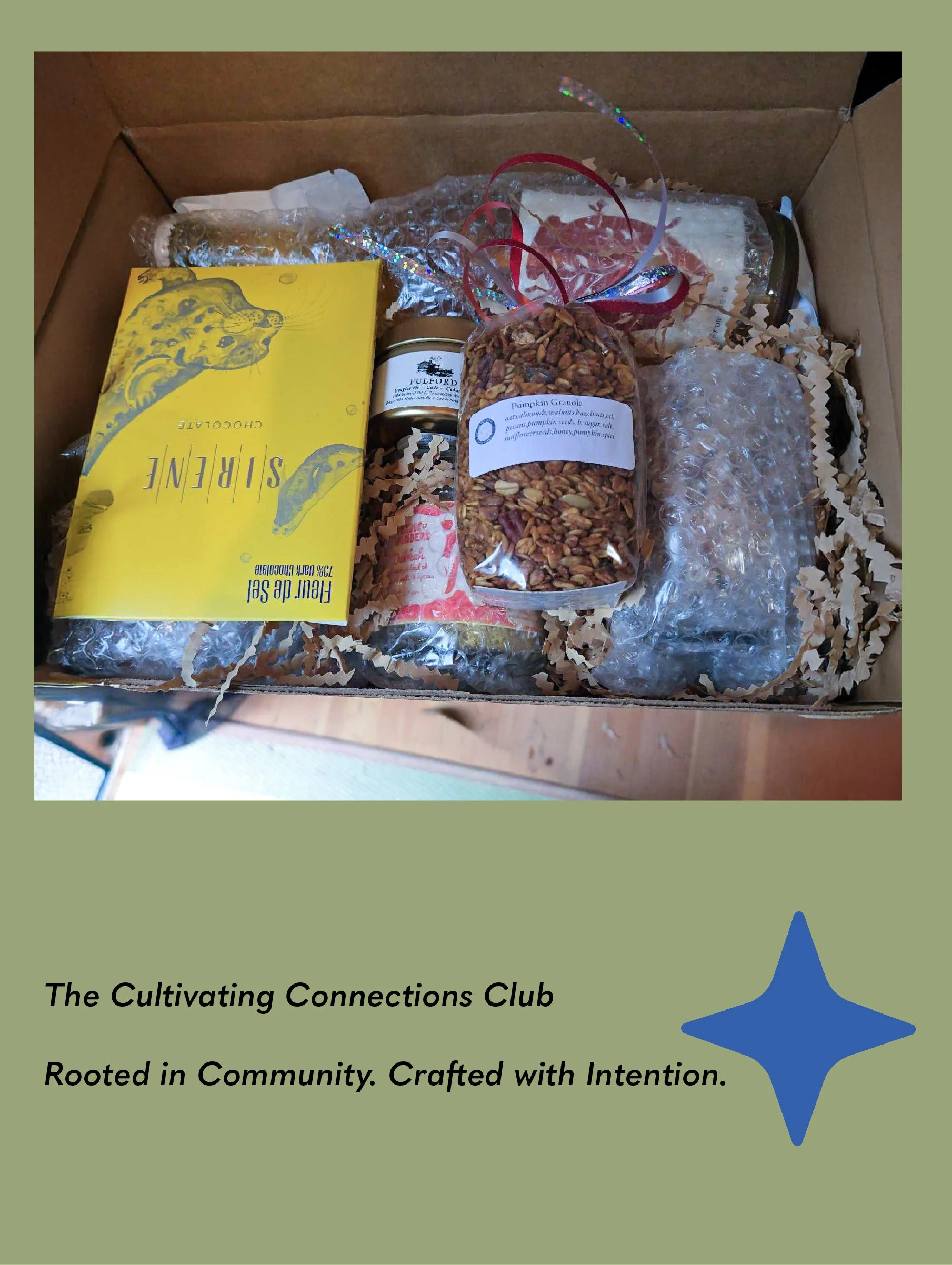

Cultivating Connections Club

If you've sent someone our way this year, thank you. Your trust and support genuinely mean a lot, and referrals are one of the biggest compliments we can receive.

As a small gesture of gratitude, we've created something we're calling the Cultivating Connections Club: a curated collection of gifts from local artisans and small B.C. businesses we love. When you refer someone to us who proceeds with their mortgage financing, you can look forward to a special surprise from some of our favourite makers and creators. Leave us a review to join as well!

Your gifts are on their way, and we're really excited for you to see what we've put together this year. When it arrives, feel free to share a photo with us (or post it on social and tag us). We love seeing the goodies land in the wild.

Grateful to be in your corner

Whatever 2026 brings, you don't have to navigate it alone. With a little planning and the right structure, most mortgage decisions become a lot less stressful and a lot more empowering. If your renewal is coming up, reach out early and we'll map out a clear path forward together.

Warmly,

Catherine Melville

CEO & Mortgage Professional

Cultivate + Evolve Financial Inc.

Founder of Cultivating Conversations