2026 Housing and Interest Rate Outlook: What We’re Watching

As we head into 2026, Canada’s housing market appears to be finding more balance after several turbulent years. Rate cuts over the past year have eased some pressure on borrowers, but affordability remains stretched in many markets, and supply constraints continue to shape pricing and competition.

Looking ahead, most forecasters are expecting a continued recovery, but a measured one. The expecation across many outlooks is steady activity and modest price growth, rather than a rapid return to an overheated market.

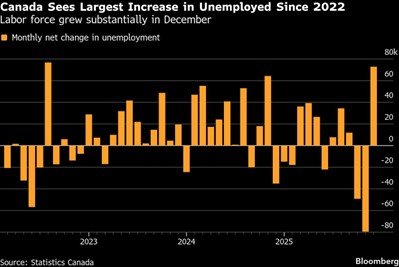

Unemployment and fear of layoffs:

A softer labour market can impact confidence and lender scrutiny.

We are in a period of uncertainty, and many industries are experiencing hiring slowdowns or layoffs. Even when the overall economy looks “fine” on paper, households feel the impact through job security, confidence, and decision-making.

Recent commentary has highlighted unemployment reverting to 6.8%, and a labour market that may not yet be fully out of the woods. This matters because a softer labour market tends to influence consumer behaviour, borrowing confidence, and in some cases lender caution.

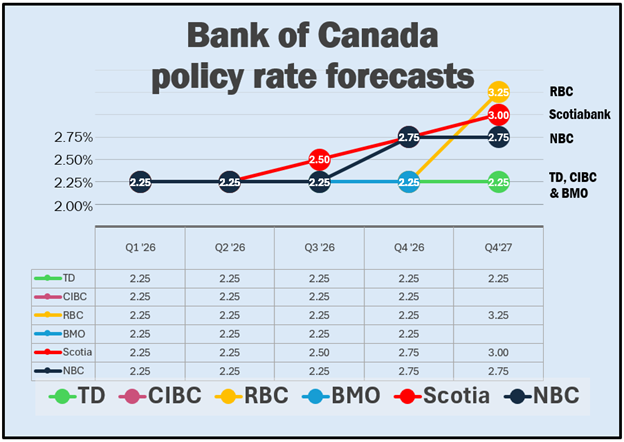

Bank of Canada predictions for 2026

Most major banks expect the overnight rate to sit at 2.25% through much of 2026, reflecting a cautious approach guided by incoming inflation and labour-market data.

By late 2026, forecasts begin to diverge.

Scotiabank and National Bank anticipate modest rate increases by late 2026

RBC projects potential rate hikes extending into 2027, with the overnight rate rising back toward 3.25%

The takeaway is not that one forecast is “right.” It is that the further out we look, the wider the range of reasonable scenarios becomes. That is why planning and decision-making in 2026 should be grounded, flexible, and responsive to data as it arrives.

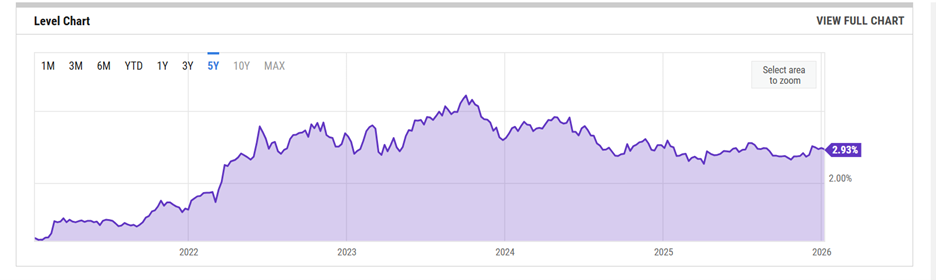

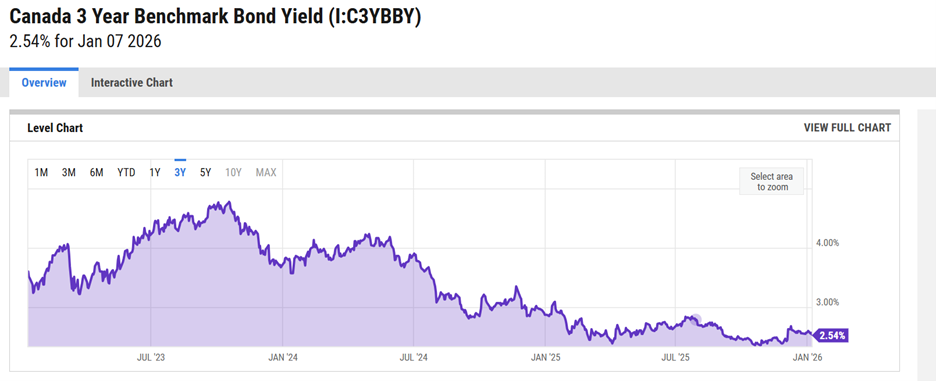

5-year bond yields

Bond yields continue to matter, particularly for fixed mortgage pricing. Fixed rates do not move in lockstep with the Bank of Canada overnight rate. In many cases, bond market expectations can influence fixed rate pricing before, after, or even independently of changes in the overnight rate.

This is one reason market conditions can feel confusing in real time, and why the most reliable approach is to monitor both policy direction and bond yield movement when assessing the broader rate environment.

The housing market leading into 2026

As 2026 begins, the market outlook from many forecasters points to steady recovery, with affordability challenges and limited supply keeping conditions from overheating.

Below is a snapshot of housing and interest rate forecasts for 2026 from major real estate firms and bank economists.

Canadian Real Estate Association (CREA)

2026 home sales forecast: 509,479 (+7.7% year-over-year)

Commentary: Since March 2025, home sales activity has been ongoing, with demand described as delayed and dampened, but not derailed

2026 home price forecast: $698,622 (+3.2%)

Royal LePage

2026 house price forecast by Q4: $823,016 (+1% year-over-year)

Commentary: Solid fundamentals and improved rate conditions point to more sustainable, modest price growth

RE/MAX

2026 national average price outlook: -3.7% year-over-year

2026 national home sales outlook: +3.4% year-over-year

Commentary: Economic uncertainty remains a factor, with many buyers finding creative ways to enter the market

RBC Economics

2026 home resales forecast by Q4: 502,300 (+6.7% year-over-year)

2026 home price forecast by Q4: $812,700 (-0.9%)

Commentary: As rate conditions stabilise, there may be a release of demand that accumulated during the period of elevated borrowing costs

TD Economics

Home price growth forecast: +4.1%

Commentary: Softer conditions in B.C. and Ontario may be offset by stronger price growth in tighter markets such as Quebec

Across forecasts, the theme is consistent: recovery is underway, but it is expected to be steady and sustainable, not overheated.

A shift we’re seeing: buyer psychology

What is equally important is the shift in borrower and buyer psychology. Now that many lenders and economists believe we have reached a more stable rate environment, people who were waiting on the sidelines may begin to re-engage.

For some, this means moving forward with a purchase they delayed. For others, it means revisiting plans with more confidence around where rates are likely to settle. Even in a stable-rate environment, renewed confidence can support gradual improvement in housing activity through 2026.