Navigating the Changing Landscape – The Fall Market 2023

In today’s rapidly changing world, uncertainty seems to be the only constant. From climate change and record-high inflation to global instability, it’s easy to feel overwhelmed by the challenges facing us. Yet, amidst this uncertainty, we want to emphasize why planning for the future is more important than ever before.

The Quest for Control

One common thread among all of us is our desire for some degree of control over our lives and the world around us. We work hard, juggle multiple responsibilities, and face the pressures of a shifting economic landscape. Grocery bills may feel like they’re from Whole Foods while you’re at the self-checkout in Walmart, stru

ggling to manage it all. We want to plan for a more predictable future, one filled with consistency, stability, security, and progress toward our dreams.

Acknowledging the Hardships

Let’s be honest; life is challenging right now, regardless of your financial situation. Times have changed significantly, and they will continue to evolve. The key to facing these challenges head-on lies in being well-informed, supported, and proactive about your options.

Understanding the Economic Landscape

To make informed financial decisions, it’s imperative to grasp the current economic landscape. Let’s delve into some key statistics and trends that can significantly impact your financial strategy:

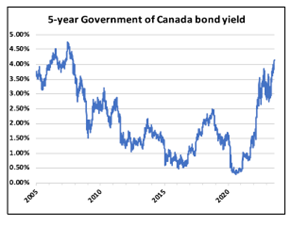

Interest Rates at Elevated Levels:

5 Year Bond Yields reached 16-year highs in August at 4.15% (they are now down to 3.82%) which is helping alleviate some pressure on the fixed rate environment:

As quoted by Ben Rabidoux – Interest rates tend to take the stairs up and the elevator down – so anticipation is rates will fall quickly once they commence.

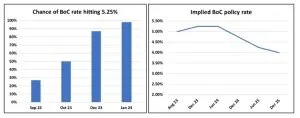

The Bank of Canada expectation of one further hike prior to things pivoting – rises as we reach towards the last quarter of 2023. With anticipation it will commence inverting by mid 2024.

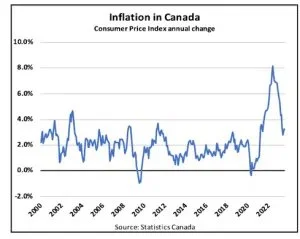

Inflation

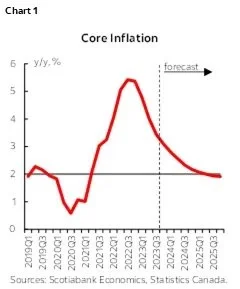

Global Inflation has come down from it’s peak but remains above central bank targets.

Canadian Core Inflation – has fallen from a peak of 5.4% to 3.42% – with anticipation it will return to 2% by the second quarter of 2025.

The Bank of Canada remains committed to reducing inflation – and will continue to do what is necessary to get to its target of 2% – which could result in further hikes.

Real Estate Market Dynamics:

Home Prices Nationally are 12% below peak levels but there is substantial variations by regional area see attached.

Homes listed for sale across Canada remain far below pre COVID levels as per the below.

Escalating Rental Costs:

Rental prices are once again experiencing an upward trajectory.

Historical Low Housing Starts Across Canada:

Canada has experienced historically low housing starts in recent years.

Immigration and Housing Demand Exceeding Availability:

Immigration accounts for almost 100% of Canada’s labour force growth.

Roughly 75% of Canada’s population growth comes from immigration, mostly in the economic category.

By 2036, immigrants will represent up to 30% of Canada’s population, compared with 20.7% in 2011.

Over the last year, immigration numbers surged by approximately 35%, intensifying the competition for available housing.

Remember, knowledge is a powerful tool, and being well-informed positions you for a more secure financial future.

Why These Factors Matter

Understanding these factors is crucial because they directly impact your financial choices. When interest rates eventually come down, many will seek opportunities in the housing market.

Economists are predicting another surge in home prices in 2024/2025. Therefore, while interest rates may be higher now, this might be the right time to prepare, explore your options, and determine your budget.

If you’re already in the housing market, you likely have built equity, which can serve as an asset on your path to your next property or investment. Various mortgage options can enable you to maintain your current low rate while considering additional funds at prevailing rates or blending your existing rate with new ones.

If this sounds intriguing and you’d like to explore these possibilities further, please reach out to us, and we’ll be delighted to guide you through the process.

Planning for Financial Wellness

Planning for financial wellness is a crucial step towards achieving stability and security in these challenging times. Fortunately, many lenders now offer a range of solutions to help you take control of your financial situation.

Here are some additional options to consider:

Refinancing

Registered Second Mortgage

Home Equity Line of Credit (HELOC)

Debt Consolidation

Each of these options has its advantages and considerations, so it’s important to explore them with a trusted financial advisor to determine the best fit for your specific circumstances.

Remember that taking proactive steps towards financial wellness is a powerful way to regain control over your financial future and work towards your goals and dreams.

If you’re unsure about which option is right for you or have any questions about planning for your financial well-being, don’t hesitate to reach out to us. We’re here to provide guidance and support on your journey to financial security and prosperity.

Schedule – Cultivate + Evolve (cultivateevolvefinancial.com)

In this uncertain world, planning isn’t just a wise choice—it’s a necessity. Let’s face the challenges ahead with confidence and determination.

Best Regards,

Catherine Melville

Cultivate + Evolve Financial

A lender assisting clients with their mortgage needs, showcasing the personalized support that helps borrowers navigate the home financing process. This image introduces our Lender Spotlight series, highlighting the people behind the lending experience.